THE TAKEAWAY: Weaker trade balance, retail sales > Less pressure on RBA to raise rates > AUD weakens

An unexpected shrink in retail sales and lower trade balance sapped confidence in the Australian dollar, pushing it below 1.0700 for the first time since July 21st. The sharp fall in sales suggests that the domestic economy may be slowing, resulting in a longer delay of the next RBA rate hike.

EVENT | ACT | EXP | PREV |

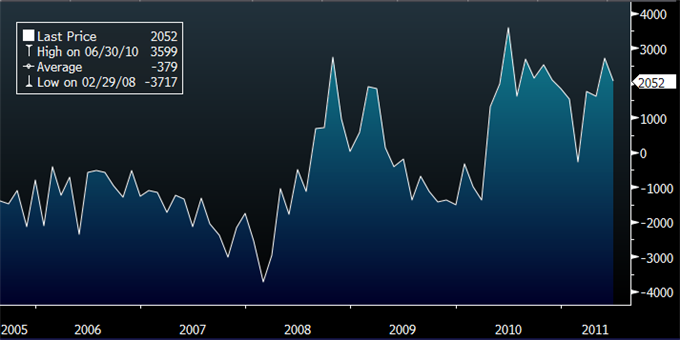

Trade Balance (JUN) | 2052M | 2200M | 2699M |

Retail Sales SA (MoM) (JUN) | -0.1% | 0.4% | -0.6% |

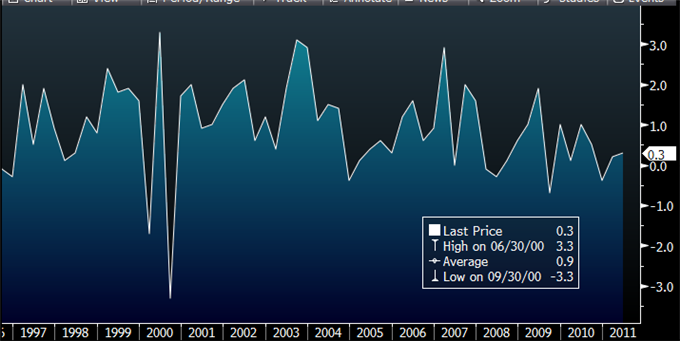

Retail Sales ex Inflation (QoQ) (Q2) | 0.3% | 0.4% | 0.2% |

Following yesterday’s more cautious RBA commentary after the central bank held rates steady for the 7th straight month, outlook for further rate hikes were dampened. Traders are currently expecting an 85bps rate cut by the bank over the course of the next 12 months. Additionally, yields on all Australian sovereigns dropped below its target cash rate of 4.75% with 2023 bonds dropping to 4.74%. This is the first time this has happened since 2009.

Australia Trade Balance. Chart generated with Bloomberg LP Professional Terminal.

Australia Retail Trade ex Inflation. Chart generated with Bloomberg LP Professional Terminal.

The Australian dollar fell immediately after the report after the data cemented traders’ concerns that the RBA may slow their rate policy, and could possibly even cut rates as the domestic economy slows. Additional concerns that the increasingly tightening Chinese economy may cut into demand for Australian exports led to a continued dumping of the southern currency. At the time of writing, the Australian dollar has lost 0.823% against the US dollar since the start of the trading session.

AUDUSD 5 minute chart; vertical line indicates time of data release. Chart generated with FXCM Strategy Trader